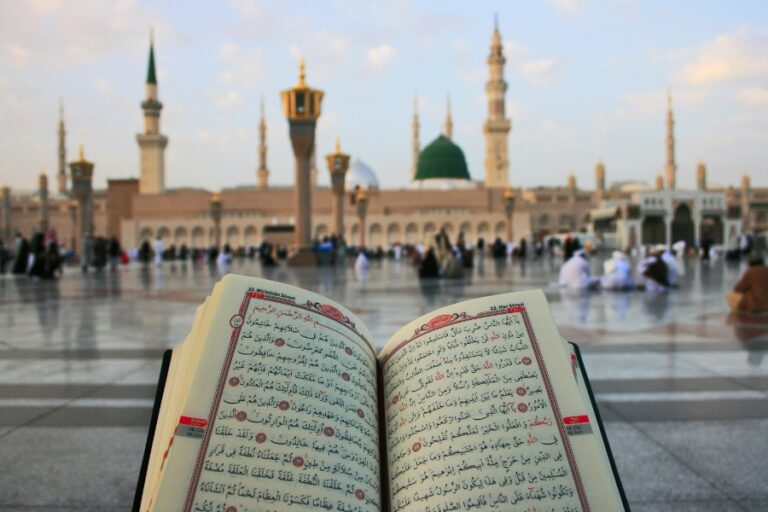

October Umrah Packages are widely considered the smartest month...

Wenn man von amerikanischen Autos spricht, denkt man sofort...

Step into the whimsical world of Labubu Doll Clothing,...

When it comes to fashion, Sp5der Hoodie Clothing Hoodie....

Managing finances can often feel overwhelming, especially when you’re...

Managing your finances can be overwhelming, whether you’re running...

Managing a business comes with countless responsibilities, and keeping...

Gynecomastia, the enlargement of male breast tissue, affects many...

Cricket lovers across India are generally looking for faster...

SEBI Registered Investment Advisor Eligibility – A Complete Guide...